|

Europe

> Money > ATM conversion fees

ATM 'Conversion Fees'

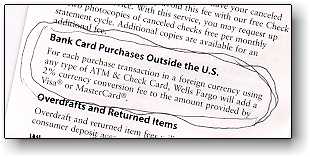

ABOVE: Wells Fargo slipped this bombshell into

a statement insert a few years ago, when the trend toward "conversion fees"

began.

By

Durant Imboden

Most experienced travelers will tell

you that ATMs are the cheapest way to get cash overseas. For that matter, so

does Visa, which handles currency conversion for banks around the world. Here's a statement from the Visa Global ATM Network Web page:

"Withdrawing cash at Visa/PLUS ATMs using a secured PIN

can save you money and makes it easy to take advantage of the favorable

exchange rates offered by ATMs. Cash withdrawals are dispensed in local

currency, and are debited from your account in your own currency - this

eliminates additional currency conversion fees and commissions often assessed

by traditional currency exchange bureaus."

Well, think again. Most banks tack an additional "conversion

fee" onto the Visa or MasterCard currency-exchange commission. Not only

that, but this hidden surcharge is on top of the flat "ATM-use" or transaction fees

that banks often charge for ATM withdrawals away from home.

Example: Wells Fargo, one of the largest banks in the U.S., charges a

conversion

fee "for each purchase transaction in a foreign currency using any type of

ATM & Check Card." The charge, which was recently raised from 2% to 3%, is in addition to the standard

1% currency-exchange commission levied by the Visa/MasterCard international

clearinghouse.

Let's do the math: For a withdrawal of US $100 in a

foreign currency, a Wells Fargo customer is paying a $1 currency-exchange

commission to the international clearinghouse, an additional $3 Wells Fargo conversion fee or

surcharge, plus a

flat $5 ATM transaction fee. Total cost: $9, which is equal to an eye-popping

8% exchange commission.

Such fees aren't limited to banks in the U.S. Many British banks now have

"currency conversion fees," and the epidemic has spread to other countries. In

June, 2007, an Australian reader reported:

"My

daughter is visiting Europe using a cashpassport card and ATMs displaying

the Visa sign. The cost of euros in Australian dollars was as expected in

the UK, higher in Paris and Germany, but from Prague she reported 300 Euros

cost up to AUD523. This must be about 9% on top of the flat transaction fee

of $3.75."

How can you avoid being gouged by high ATM surcharges?

- One way is to switch banks. You'll nearly always pay the 1% wholesale

exchange commission (which is only reasonable), but you can avoid bank

surcharges if you shop around or--in some cases--if you're a big-balance

customer at a bank that normally charges conversion fees.

- You can avoid the flat ATM-use fees (such as Wells Fargo's $5

overseas transaction fee) by getting your card from a Global ATM Alliance

bank and using member banks' ATMs abroad. The alliance has nine member banks

in eight countries, including Bank of America in the U.S., Barclays in the

UK, and Deutsche Bank in Germany. Also, the Wall Street Journal

reports that HSBC and Citibank have 18,000 ATMs each in more than 40

countries, and U.S. customers of those banks don't pay an ATM-use fee at

foreign locations.

- You can also minimize ATM fees by charging most purchases with a Visa or MasterCard. But watch out--some banks and other card issuers have

credit-card surcharges of up to 5%.

- Finally, be aware that some local banks or private ATM owners may tack

on their own fees. You'll

minimize the risk of such charges by using ATMs at major banks and post

offices.

Bottom line:

As banks lose income from traveler's checks, they're

looking for new ways to extract money from overseas travelers. Check your bank's

policy on conversion and transaction fees before you use an ATM card abroad--and

if you feel that your bank's fees are unreasonable, look for a less greedy bank.

| Another conversion scam: Merchant fees

Kelly K. Spors of The Wall Street Journal reports that some

hotels, stores, and other merchants are now charging foreign customers

in their home currencies. For example, an American visiting London might

receive a hotel bill in U.S. dollars instead of pounds sterling.

This "convenience" comes at a price, since the merchant is typically

padding the bill with a 2% to 5% commission on the currency exchange.

To avoid such fees, tell the merchant that you want to be billed in

local currency, and refuse to sign a charge slip in your own currency.

(According to the Journal, Visa requires merchants to let

customers opt out of conversion, and American Express waives its 2%

conversion fee if the merchant has performed the conversion.) |

About the author:

Durant Imboden

is a professional travel writer, book author, and editor who focuses on European

cities and transportation. Durant Imboden

is a professional travel writer, book author, and editor who focuses on European

cities and transportation.

After 4-1/2 years of covering European travel topics for About.com, Durant and

Cheryl Imboden co-founded Europe for Visitors in

2001. The

site has earned "Best of the Web" honors from Forbes and The

Washington Post.

For more information, see

About

Europe for Visitors,

press clippings, and

reader

testimonials.

| |

|